Last Updated on August 25, 2021 by Admin

Indian ports are facing some challenges as far as infrastructure and operation parameters come into play. Although the operational efficiency of Indian ports has improved over the years, it still lags as compared to the global average. One of the significant elements that will shape international trade’s future is the Turnaround time (TAT). We have discussed here the most promising SagarMala project.

TAT at important ports was approximately four days in 2014-15, whereas the global average benchmark is 1-2 days. On the other hand, some of the private sector ports in India, like Mundra and Gangavaram, have achieved a turnaround time of around two days.

The stats reveal that almost 94% of Indian freight uses either road or rail to transport goods. A significant share of this cargo experiences “idle time” during transit to the ports due to capacity constraints on highways and railway lines connecting ports to production and consumption centers. In addition to that, last-mile connectivity to the docks is one of the significant constraints in the smooth movement of cargo to and from the hinterland.

Still, most transporters do not choose waterways, although water-borne transport is much safer, cheaper, and cleaner than other modes of transportation. Water transport accounts for only 6% of India’s modal split. If we compare this with international players like China, Japan, or the US, coastal and inland water transportation contributes to 47% of China’s freight modal mix. In Japan and the US, this share is 34% and 12.4%, respectively.

High transportation costs can be saved if significant transporters of industrial commodities like coal, iron ore, cement, and steel shift their transportation activities to coastal and inland waterways. For example, transportation of coal through coastal shipping costs one-sixth (Rs. 0.20 per tonne-kilometers) compared to rail (Rs. 1.20 – 1.40 per tonne-kilometers). However, more than 90% of coal currently moves via railways, attracting a higher logistic cost. It ultimately affects the overall budget of the manufacturing sector and export competitiveness.

Another essential element in the trade is the location of industries or manufacturing centers vis-à-vis the ports. If we carefully look at the differential between India and China, it is not significant on a per tonne-km basis; however, China still has a lower container exporting cost than the cost in India, and the main reason behind this is the lower lead distances. The presence of significant manufacturing and industrial zones in coastal regions in China, which were developed as part of the Port-Led Policy of the government, is the main reason for lower lead distances.

Any program for port-led development needs to consider the factors mentioned above to harness the potential of India’s long coastline effectively.

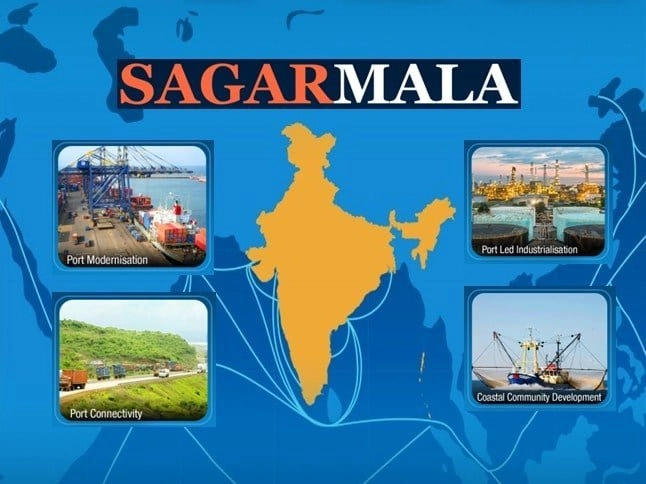

The maritime sector in India has been the backbone of its international trade, and it has grown manifold over the years. To make the best out of India’s 7,500 km long coastline, 14,500 km of potentially navigable waterways, and strategic location on key international maritime trade routes, the Government of India has started working on the ambitious Sagarmala Project, which aims to promote port-led development in the country. The concept of Sagarmala was approved by the Union Cabinet on 25th March 2015. As part of this program, a National Perspective Plan (NPP) for the comprehensive development of India’s coastline and the maritime sector was prepared and released by the Hon’ble Prime Minister on 14th April 2016 at the Maritime India Summit 2016.

Table of Contents

Components of the Sagarmala Programme are:

- Port Modernization & New Port Development: De-bottlenecking and capacity expansion of existing ports and development of new greenfield ports

- Port Connectivity Enhancement: Enhancing the connectivity of the ports to the hinterland, optimizing cost and time of cargo movement through multi-modal logistics solutions including domestic waterways (inland water transport and coastal shipping)

- Port-linked Industrialization: Developing port-proximate industrial clusters and Coastal Economic Zones to reduce logistics cost and time of EXIM and domestic cargo

- Coastal Community Development: Promoting sustainable development of coastal communities through skill development & livelihood generation activities, fisheries development, coastal tourism, etc.

Sagarmala Development Company Limited:

The Sagarmala project will be implemented as well as all development activities will be taken up by the relevant ports, ministries, state governments, maritime boards through a PPP model. The Sagarmala Development Company Limited (SDCL) has been incorporated on 31st August 2016 under the Companies Act, 2013, after obtaining approval of the Union Cabinet on 20th July 2016.

SDCL has been set up under the administrative control of the Ministry of Shipping with an initial Authorized Share Capital of Rs. 1,000 Crore and a Subscribed Share Capital of Rs. 90 Crore. SDCL will provide equity support for the Special Purpose Vehicles (SPVs) set up by the Ports / State / Central Ministries and funding window and implement only those residual projects that cannot be funded by any other means/mode.

New Port Development under Sagarmala Project:

Six new significant ports are planned, which will help to bring in considerable capacity expansion to fill the trade demand gap. The locations of these new ports are deliberated after a detailed origin-destination study of cargo commodities, and there are mainly three levers that propel the need for building new ports: New port locations have been identified based on the cargo flow for essential commodities and the projected traffic:

Greenfield ports are proposed to be developed at

- Madhavan (Maharashtra),

- Sagar Island (West Bengal)

- Paradip Outer Harbour (Odhisha)

- Cuddalore/Sirkazhi (Tamil Nadu)

- Belikeri (Karnataka)

- Enayam (Tamil Nadu)

It is expected that approximately 2 to 3 lakh construction jobs would be created under the Sagarmala project and all infrastructure development activities associated with the project, including the development of new ports, enhancement of port capacity, improvement of the railroad, and multimodal transportation systems. These jobs would be available for the duration of the construction phase of the projects.

As part of Sagarmala, high potential port-linked industries have been identified, including bulk and discrete manufacturing. Bulk manufacturing industries include steel and steel-multiplier, cement, refining, petrochemical, and power, while discrete manufacturing industries include electronics, apparel, furniture, footwear, and food processing. Cumulatively, these sectors can create 40 lakh direct and 60 lakh indirect jobs by 2025.

So construction professionals need to keep an eye on all the employment notifications and become a part of this fantastic mega project to use it as a career launchpad.

References:

- The Sagarmala Project website (click here to visit)

- The Sagarmala Project- National Perspective Plan 2016 (click here to visit)