Last Updated on December 12, 2025 by Admin

As U.S. cities confront record office vacancies and a deepening housing shortage, office-to-residential conversions in 2026 are emerging as one of the most impactful urban redevelopment trends of the decade. Backed by expert forecasts, government incentives, and real estate market data, adaptive reuse is reshaping downtown skylines and creating new opportunities for developers, investors, and construction professionals. This analysis highlights the top cities leading the movement—and why 2026 is set to be a pivotal year for transforming obsolete office towers into much-needed homes.

ConstructionCareerHub App is LIVE — built ONLY for construction careers. Don’t apply with a weak resume.

Get ATS-ready Resume Lab + Interview Copilot + Campus Placement Prep (resume screening, skill gaps, interview readiness) — in minutes & Other advanced features.

Explore Smarter Construction Career Tools →Quick check. Big impact. Start now.

Table of Contents

Why a Conversion Wave Is Sweeping U.S. Cities

Over two decades after the dot-com bust, downtown office towers are again up for reinvention. Hybrid work and e-commerce have left millions of square feet of once-prized office space sitting empty. U.S. office vacancy rates climbed above 20% in early 2025, up from 19.7% a year earlier. That vacancy translated to 5.44 billion square feet of unused space—enough to house roughly 1.25 million apartments if every floor were converted.

At the same time, America faces a severe housing shortage; major metropolitan areas such as New York, San Francisco, and Seattle routinely appear on lists of the least affordable cities. The dual crises of empty offices and unaffordable housing have created an opportunity that city governments, developers, and investors are seizing—creating significant demand for construction industry professionals.

Real-estate analytics firm RentCafe notes that office-to-apartment conversions now account for about 42% of all adaptive-reuse projects, and the pipeline of future units has tripled since 2022. CBRE’s mid-2025 report showed 23.3 million sq ft of U.S. office space on track for conversion or demolition—a figure larger than the 12.7 million sq ft of new office supply expected that year.

More than 70,700 housing units from converted offices are slated to deliver in 2025, double the previous year. Although 2026 forecasts are still developing, the surge in announced projects, new tax incentives, and zoning reforms suggest that conversions will continue to accelerate through 2026 and beyond.

Key Takeaways

1. U.S. office vacancy exceeds 20%, creating unprecedented opportunities for adaptive reuse projects

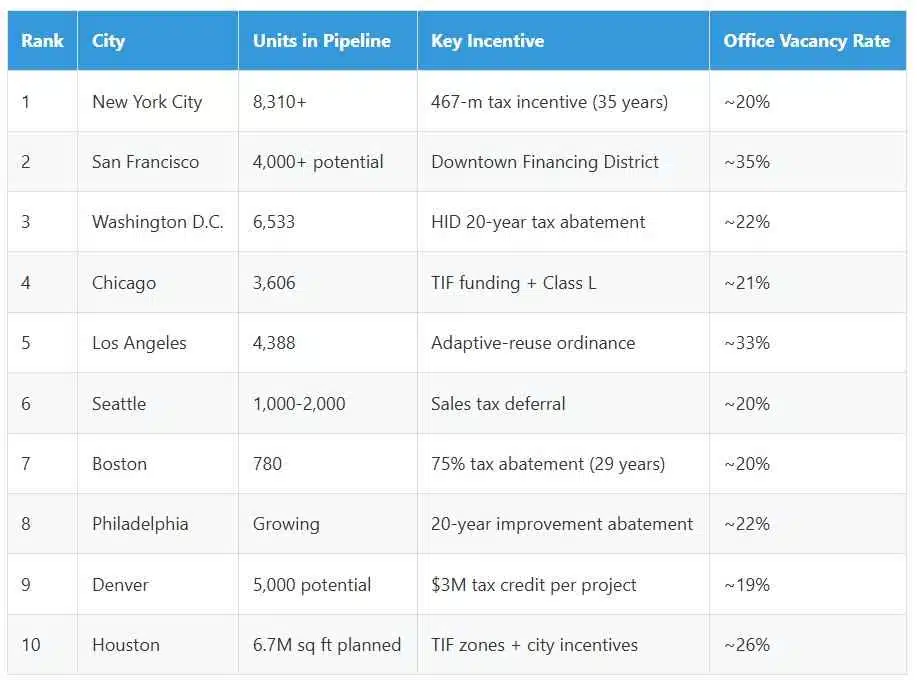

2. New York leads with 8,310+ units in its conversion pipeline, followed by Washington D.C. and Los Angeles

3. Tax incentives ranging from 20 to 35 years are making conversions financially viable

4. Construction professionals specializing in structural engineering, MEP redesign, and BIM are in high demand

5. Conversion costs range from $300,000 to $500,000+ per unit depending on location and building complexity

Why Office-to-Residential Conversions Are Surging in 2026

Economic and Market Drivers

Persistent office vacancies remain the primary catalyst. The national office vacancy rate exceeded 20% by early 2025, leaving hundreds of millions of square feet unused. Many older downtown towers have high vacancies or negative net absorption. For example, Los Angeles’ downtown market saw vacancy reach 33.3% and availability 36.8% in late 2024.

Permanent hybrid work continues reshaping commercial real estate. Employers continue to downsize footprints as employees telework two to three days per week, reducing corporate space requirements and keeping sublease availability high across metropolitan cores.

Housing affordability crisis drives urgent demand. The need for rentals and starter homes far outpaces supply in many cities. Conversions offer a quick way to add housing without greenfield development, helping ease pressure on rents and home prices. This creates opportunities for professionals in urban planning careers and related fields.

Government incentives have rolled out at local and state levels. Tax abatements, financing districts, and zoning reforms make conversions financially feasible despite high construction costs and interest rates. Examples include New York City’s 467-m tax incentive, Boston’s 29-year 75% tax abatement, Seattle’s sales-and-use tax deferral program, and Washington D.C.’s 20-year tax abatements for downtown conversions.

Redevelopment over demolition aligns with ESG objectives. Conversions reduce carbon emissions associated with demolition and new construction while retaining architectural heritage—making downtowns more diverse and lively. This supports the broader movement toward sustainable construction practices.

Policy Initiatives Accelerating Conversions

City of Yes (New York): New York City overhauled its zoning code in late 2024. According to AECOM, the initiative allows buildings built as recently as 1990 to be converted to housing wherever residential use is permitted. It increases floor-area ratios via the Universal Affordability Preference and is expected to facilitate about 80,000 new housing units over the next 15 years.

State and Local Tax Deferrals/Credits: Seattle’s Council Bill 120937 defers the city’s 10.3% sales-and-use tax for qualifying conversions, allowing developers to stack this deferral with the city’s multifamily property-tax exemption. Colorado’s HB24-1125 (effective January 2026) offers a refundable tax credit up to $3 million per project for adaptive reuse and conversion costs.

Downtown Financing Districts: San Francisco established a Downtown Revitalization Financing District to invest future property-tax increments back into conversion projects. City officials estimate that 50 properties could yield over 4,000 units, lowering per-unit costs by $250,000–$300,000. Similar tax-increment financing districts exist in Chicago and Dallas.

Abatement Programs: Boston’s program offers a 75% property-tax abatement for 29 years to qualifying projects, while Washington D.C.’s Housing in Downtown (HID) program provides a 20-year tax abatement aiming to attract 15,000 new residents to the downtown core.

Ranking Criteria Used

To identify the leading conversion hubs for 2026, the following factors were weighed: scale of existing and planned conversions (number of projects and units), vacancy-to-demand ratio, local incentives and policies, investment activity and developer interest, and projected housing need based on future demand for rentals and population growth.

Top 10 Cities Leading Office-to-Residential Conversions in 2026

1. New York City, New York

Why it ranks high: New York is America’s largest adaptive-reuse market. RentCafe ranks the metro first with 8,310 units in the conversion pipeline, and CBRE lists 10.3 million sq ft of office space undergoing conversion—more than any other market.

Case studies: The conversion of 25 Water Street—a 1960s office tower near Wall Street—will deliver about 1,300 apartments, making it the largest office-to-residential conversion in city history. The project at 55 Broad Street, a 425,000-sq-ft office building, is being converted into 571 apartments. According to a 2025 mayoral report, more than 12,000 homes are already in the pipeline from office conversions, including over 3,000 permanently affordable units.

Cushman & Wakefield notes that Manhattan’s conversion activity increased from 1.6 million sq ft in 2023 to 4.1 million sq ft by August 2025, with an additional 8.8 million sq ft in the pipeline. If all proposed projects proceed, office vacancy rates in Manhattan and Downtown could fall by nearly 1 percentage point.

Challenges: Strict building codes, high construction costs, and complex floor plates present obstacles. Many structures built post-1961 have central cores and large floor sizes requiring creative engineering and significant capital. This creates demand for experienced construction managers who can navigate these complexities.

2026 outlook: The pipeline and supportive policy environment suggest conversions will expand beyond Lower Manhattan into Midtown and outer boroughs.

2. San Francisco, California

Why it ranks high: Downtown San Francisco has one of the highest office vacancy rates in the nation—around 35% in the city’s Financial District. The Kaplan Group estimates converting all vacant offices in San Francisco could yield 61,603 potential apartments—the second-highest total among U.S. cities. A February 2025 analysis notes that 83 million sq ft of office space (roughly 25% of the metro’s inventory) is suitable for conversion.

Case studies: High-profile projects include the ARCO Tower conversion at 1055 Seventh Street, where developer Jamison plans 686 apartments in a 32-story tower built in 1987. Jamison’s approach avoids a full seismic retrofit, saving an estimated 10% in construction costs. However, conversion costs averaging about $531 per square foot make San Francisco’s projects some of the most expensive in the country—roughly 60% more than San Diego and triple the cost in Texas.

Incentives: In June 2025, Mayor Daniel Lurie signed legislation creating the Downtown Revitalization Financing District. The program aims to reduce per-unit costs by $250,000–$300,000, complementing prior measures that waived transfer taxes, planning fees, and some code requirements.

Challenges: Building codes require seismic retrofits; new mechanical shafts and light wells must be carved into deep office floorplates. San Francisco’s aging office stock often lacks operable windows and natural light. These factors drive demand for specialists in BIM and structural engineering.

2026 outlook: The financing district and state law AB 2488 (allowing tax-increment financing in downtowns) should make conversions more feasible, though San Francisco’s pace will lag peers due to cost burdens.

3. Washington, D.C.

Why it ranks high: The nation’s capital combines high office availability with ambitious policies. RentCafe lists D.C. as the second-largest conversion market with 6,533 future units. CBRE reports 9.2 million sq ft of office space being converted or demolished.

Case studies: Mayor Muriel Bowser’s September 2025 announcement noted that HID has selected eight projects converting 2.1 million sq ft of office space into 1,745 apartments (176 affordable units). The flagship project at 1990 K Street NW will transform a 415,000-sq-ft office building into 434 apartments. Overall, the HID program plans to invest about $41 million to deliver 6.7 million sq ft of new residential use (roughly 8,400 units).

Incentives: D.C.’s program offers tax abatements, forgivable loans for predevelopment, and financing support for infrastructure upgrades. The eligible area was expanded in FY26 to include the Near Northwest planning area.

2026 outlook: With strong political support and funding, D.C. is positioned to remain a top conversion market.

4. Chicago, Illinois

Why it ranks high: Chicago’s Central Loop is dotted with older office towers built between the 1920s and 1970s, many now outdated and vacant. RentCafe ranks Chicago fourth with 3,606 units in its conversion pipeline. Kaplan’s study estimates 46,504 potential apartments if the city converted all vacant office space.

Case studies: LaSalle Street Reimagined, launched in 2023, uses tax-increment financing (TIF) to bridge financing gaps. Five projects slated for approval share about $250 million in TIF funding and will include 400 affordable units. The first project at 79 West Monroe Street will convert an Art Deco office tower into 117 apartments, 41 affordable to households earning up to 60% of area median income.

Incentives: Chicago leverages TIF districts providing grants covering up to 30% of eligible project costs, plus a class L property-tax incentive for landmark buildings. The project at 30 N. LaSalle applied for $47 million in tax breaks.

2026 outlook: Chicago’s combination of fiscal tools and strong downtown housing demand positions it among the leaders.

5. Los Angeles, California

Why it ranks high: Los Angeles ranks third nationally for future office-to-apartment conversions, with 4,388 units in the pipeline (an 80% increase over the previous year). CBRE reports that about 25% of the metro’s office inventory—roughly 83 million sq ft—is suitable for residential redevelopment. Downtown LA’s vacancy was 33.3% at the end of 2024.

Case studies: The ARCO Tower (L.A. Care Tower) at 1055 W. Seventh Street will be converted into 686 apartments. Built in 1987, the 32-story tower will avoid a full seismic retrofit, saving about 10% in construction costs. Jamison Properties plans to keep rent-paying office tenants on some floors while converting vacant levels—showcasing a floor-by-floor approach that other developers are studying.

Incentives: The city enacted a new adaptive-reuse ordinance extending eligibility to buildings constructed after 1974 and plans to amend building codes to streamline permitting. California’s supportive environment is boosted by local tax incentives and federal historic-preservation credits.

2026 outlook: The combination of abundant vacant space and strong housing demand makes Los Angeles a clear leader for years ahead.

6. Seattle, Washington

Why it ranks high: Seattle’s downtown office occupancy remains near 50% with vacancy over 20%. The city anticipates converting 1,000–2,000 units over seven years through its Office-to-Residential Conversion Program.

Incentives: Council Bill 120937 (February 2025) created a sales-and-use tax deferral, deferring the city’s 10.3% sales tax for qualifying projects. Conversions can stack the multifamily property-tax exemption if at least 20% of units are affordable. The program gives developers three years to complete projects.

Challenges: Many downtown towers feature deep floorplates and limited operable windows. Seattle’s historically high construction costs also present hurdles. The city’s strong tech-industry base and housing demand nonetheless support continued interest.

7. Boston, Massachusetts

Why it ranks high: Boston has moved quickly to repurpose obsolete offices. The city’s Office-to-Residential Conversion Program launched in October 2023, and by mid-2025 had 780 units in its pipeline with 141 units under construction. RentCafe notes its pipeline of 762 apartments across 15 projects.

Case studies: Approved projects include 263 Summer Street (77 homes), 129 Portland Street (25 homes), and 615 Albany Street (24 homes). According to Realtor.com, by October 2025 Boston had approved 19 office-to-residential conversions and implemented as-of-right zoning downtown.

Incentives: The program offers developers a 75% property-tax abatement for 29 years—one of the most generous in the U.S. Eligibility now extends to student and workforce housing. Applicants must commence construction by December 31, 2026 to qualify.

8. Philadelphia, Pennsylvania

Why it ranks high: A major policy shift in late 2025 positions Philadelphia for rapid growth. The Pennsylvania legislature approved a bill allowing Philadelphia to offer 20-year property-tax abatements on improvements when converting underutilized properties—including offices and school buildings—into residences.

Case studies: Philadelphia’s downtown office vacancy climbed into the low 20% range in 2024. Several developers are exploring conversions of historic high-rises such as 1101 Market Street and the Centre Square complex. The city previously lacked long-term tax incentives; the new law could unlock a wave of projects akin to D.C.’s HID program.

Incentives: The new state legislation provides up to 20 years of property-tax exemption on improvements for conversions and allows buildings that cannot feasibly be reused to be demolished and still qualify.

9. Denver, Colorado

Why it ranks high: Denver’s skyline features 1980s and 1990s towers that have struggled with occupancy since the pandemic. A Stateline report notes that converting the top 16 downtown buildings could create more than 5,000 apartments. The report also notes that 22,000 apartments were created nationally from adaptive reuse between 2016 and April 2024, with 169 projects underway expected to add 31,000 units.

Case studies: Denver launched an adaptive-reuse pilot program to speed approvals and coordinate among departments. The city hired design firm Gensler to identify the 16 most convertible towers. Early candidates include 707 17th Street and 1801 California.

Incentives: Colorado’s HB24-1125 provides a refundable tax credit of up to $3 million per project, capped at $5 million per year, to offset conversion expenses like elevators, windows, and plumbing.

10. Houston, Texas

Why it ranks high: Houston has quietly amassed one of the nation’s largest conversion pipelines. CRE Daily reports 6.7 million sq ft of office space (about 3.2% of the market) is planned or underway for conversion, while overall office availability hovers around 25.9%. Kaplan identifies 52,925 potential apartments if all vacant offices were converted.

Case studies: The largest project is the former 1.1-million-sq-ft Fluor Corporation campus in Sugar Land, transforming into 720 residential units supported by $24.3 million in city-backed incentives. Other notable projects include converting 1001 Fannin Street into apartments and redeveloping Houston House near the central business district.

Challenges: The city faces high construction costs and labor shortages. Houston’s lack of zoning code eliminates some regulatory hurdles but also reduces tax incentives compared with cities offering targeted abatements.

Comparison Table: Top 10 Conversion Markets

Opportunities for Construction and AEC Professionals

The conversion boom creates significant opportunities across architecture, engineering, and construction (AEC) disciplines. For professionals looking to capitalize on this trend, here are the key specializations in demand:

Structural and Seismic Engineering: Many projects require reinforcing columns, adding shear walls or isolators, and designing new egress systems. Structural engineers with expertise in seismic retrofits and adaptive reuse are in high demand—particularly in earthquake-prone markets like California.

Mechanical, Electrical, and Plumbing (MEP) Redesign: Office buildings typically lack the plumbing stacks and HVAC zoning needed for residences. MEP engineers must design new vertical chases, route ductwork through tight floorplates, and ensure energy efficiency while meeting residential code requirements. Understanding MEP engineering fundamentals is essential for these projects.

Building Information Modeling (BIM) and Digital Twins: Accurate as-built models are critical for planning conversions. BIM specialists use laser scanning and modeling to map existing conditions and coordinate multidisciplinary changes. Digital twins enable lifecycle analysis and maintenance planning. For those exploring this career path, understanding BIM in civil engineering provides a strong foundation.

Retrofit and Interior Construction: Contractors skilled in selective demolition, floor-by-floor conversions, and façade upgrades are essential. Knowledge of fire-rating assemblies, soundproofing, and insulation is important when reconfiguring floorplates. Construction workers with specialized renovation experience command premium rates.

Sustainability and Resilience: Many conversions incorporate green building standards. Professionals familiar with LEED certification or WELL certifications can help projects meet ESG goals. Designing to adapt to future climate risks adds significant value. The broader movement toward sustainable building materials and techniques aligns perfectly with adaptive reuse objectives.

Urban Design and Placemaking: Creating appealing ground-floor retail, public space, and community amenities fosters vibrant 24/7 neighborhoods. Urban planners and landscape architects will play crucial roles in knitting converted buildings into the urban fabric. Those interested in this intersection should explore careers in urban planning for civil engineering graduates.

AEC professionals can position themselves by upskilling in adaptive-reuse best practices, investing in BIM and sustainability training, and partnering with developers who are pivoting to conversions. The future of construction careers increasingly favors those with hybrid skill sets spanning traditional construction knowledge and emerging technologies.

Investment Outlook for 2026

Investors are increasingly bullish on office-to-residential conversions for several compelling reasons:

Compelling yields: Conversions can deliver internal rates of return (IRRs) of 12–18%, higher than many ground-up multifamily projects. Developers often acquire office towers at deep discounts due to high vacancy, reducing land costs significantly.

Abundant incentives: Tax abatements and credits—including New York’s 467-m, Boston’s 75% abatement, Seattle’s tax deferral, and Colorado’s $3 million credit—reduce operating expenses and improve cash flows substantially.

High demand for rentals: Urban housing demand remains strong as young professionals and empty-nesters return to cities for amenities and walkability. Conversions in downtowns with good transit can command premium rents.

Diversification: Adding residential units to a portfolio previously heavy in office or retail reduces exposure to single-asset classes and provides resilience against market volatility.

Green value: Reusing existing structures is often less carbon-intensive than new construction. Institutional investors with ESG mandates view conversions favorably, and the integration of eco-friendly technologies adds appeal.

Risks and barriers include rising construction costs, extended timelines due to permitting and design complexity, potential structural surprises (e.g., asbestos, outdated wiring), and interest-rate volatility. Additionally, conversions may face community opposition if residents fear loss of character or increased density. Nevertheless, strong policy support in leading cities offsets some risk.

Challenges Slowing Down Conversions

Despite momentum, several factors limit how quickly and widely office buildings can become homes:

High retrofit costs: Conversions typically cost $300,000–$500,000 per unit. San Francisco’s conversions average $531 per square foot—about 60% higher than similar projects in San Diego and triple the cost in Texas.

Structural and design constraints: Many office towers have deep floorplates, central cores, and limited window openings. Cutting new light wells and installing plumbing risers can be prohibitively expensive. Buildings erected after the 1980s often require extensive seismic upgrades.

Lengthy permitting processes: Historic-preservation reviews, zoning variances, and environmental approvals add months or years. Seattle’s program gives developers three years to complete projects, but in many markets, delays can threaten financing.

Financing gaps: Lenders remain cautious about conversions because they straddle office and multifamily risk profiles. Public subsidies (TIF, tax credits) often fill gaps, but obtaining those subsidies is competitive and unpredictable.

Community resistance and political risk: Some residents oppose conversions, fearing loss of affordable offices, shadows on streets, or gentrification. Changing administrations can alter incentive programs or impose new requirements.

Construction labor shortages: Markets like Houston report labor shortages and high costs, which delay projects and inflate budgets. This challenge underscores the strong job market for skilled construction professionals.

Future Forecast: What to Expect Beyond 2026

The conversion boom shows no signs of abating. As hybrid work remains entrenched, more building owners will consider converting obsolete offices into apartments, hotels, or mixed-use developments. Looking beyond 2026, several trends are likely:

Expansion of conversion eligibility: Cities such as New York and Los Angeles have already expanded eligibility to buildings built in the 1990s; other municipalities may follow. More mid-rise and suburban offices—and even strip malls—will become candidates for housing.

Rise of mixed-use micro-districts: Successful conversions will integrate retail, coworking, cultural, and public spaces. Downtowns could transform into 18-hour or 24-hour neighborhoods, with residents supporting local businesses and reducing car dependency.

Greater emphasis on affordability: Many programs require affordable units, but future legislation may attach stricter affordability requirements. Public–private partnerships could bundle conversions with social-housing goals.

Technological advancements: Modular construction, prefab bathrooms and mechanical systems, and digital twins will streamline conversions. Innovations in construction technology could reduce unit costs, making conversions viable in smaller markets.

Environmental incentives: As cities adopt stricter sustainability standards, adaptive reuse will be promoted as an emissions-saving strategy. Carbon-credit markets or green-bond financing could support conversions. The latest green building materials will play an increasing role.

Secondary markets emerge: Cities like Phoenix, Minneapolis, Charlotte, Cincinnati, and Kansas City already show growing pipelines according to RentCafe data. As policies succeed in first-movers, mid-sized cities will implement similar programs.

Conclusion: A New Chapter for U.S. Downtowns

Office-to-residential conversions are not just a passing trend; they represent a structural shift in how American cities adapt to economic and social change. With vacancy rates hovering around 20% and housing shortages escalating, converting offices into homes addresses two crises with one policy stroke.

The cities highlighted here—New York, San Francisco, Washington D.C., Chicago, Los Angeles, Seattle, Boston, Philadelphia, Denver, and Houston—are leading the charge with innovative incentives, ambitious policies, and high-profile projects.

For construction professionals, the boom offers rewarding opportunities to apply specialized skills in structural engineering, MEP redesign, BIM, and sustainability. Those considering career advancement should explore entry-level construction management positions that often serve as stepping stones to leadership roles in adaptive reuse projects.

Investors see attractive returns and diversification benefits, even as they navigate design complexity and financial risk. Residents and urbanists will witness downtowns reborn with a mix of housing, culture, and commerce.

While challenges remain—high costs, structural constraints, community concerns—the momentum suggests that by 2026 and beyond, converted offices will be a common fixture of U.S. skylines, transforming underutilized towers into vibrant, livable homes.

Frequently Asked Questions

Office-to-residential conversion is the process of transforming commercial office buildings into residential apartments or condominiums. This adaptive reuse strategy addresses both excess office vacancy and housing shortages simultaneously.

Several factors drive the increase: persistent 20%+ office vacancy rates due to hybrid work, severe housing shortages in major metros, generous government tax incentives and zoning reforms, and investor appetite for higher yields compared to new construction.

Conversion costs typically range from $300,000 to $500,000+ per unit. San Francisco averages about $531 per square foot, while Texas markets see significantly lower costs. Factors include building age, structural requirements, seismic considerations, and local code compliance.

New York City leads with 8,310+ units in its conversion pipeline and 10.3 million sq ft of office space undergoing conversion. Washington D.C. ranks second with 6,533 units planned, followed by Los Angeles with 4,388 units.

High-demand specializations include structural and seismic engineering, MEP (mechanical, electrical, plumbing) system redesign, BIM modeling and coordination, sustainable design expertise, and selective demolition and retrofit construction skills.

Yes, conversions can deliver IRRs of 12–18%, often higher than ground-up multifamily projects. Profitability depends on acquisition price, conversion costs, local incentives, and rental market strength. Tax abatements significantly improve project economics.