Last Updated on July 13, 2025 by Admin

Are you planning to build your dream home or start a new development project? If so, understanding your financing options is crucial. One tool that can make your journey smoother is a construction loan calculator. In this comprehensive guide, we’ll explain what a construction loan calculator is, how it works, and why you should use one before starting your project.

What is a Construction Loan Calculator?

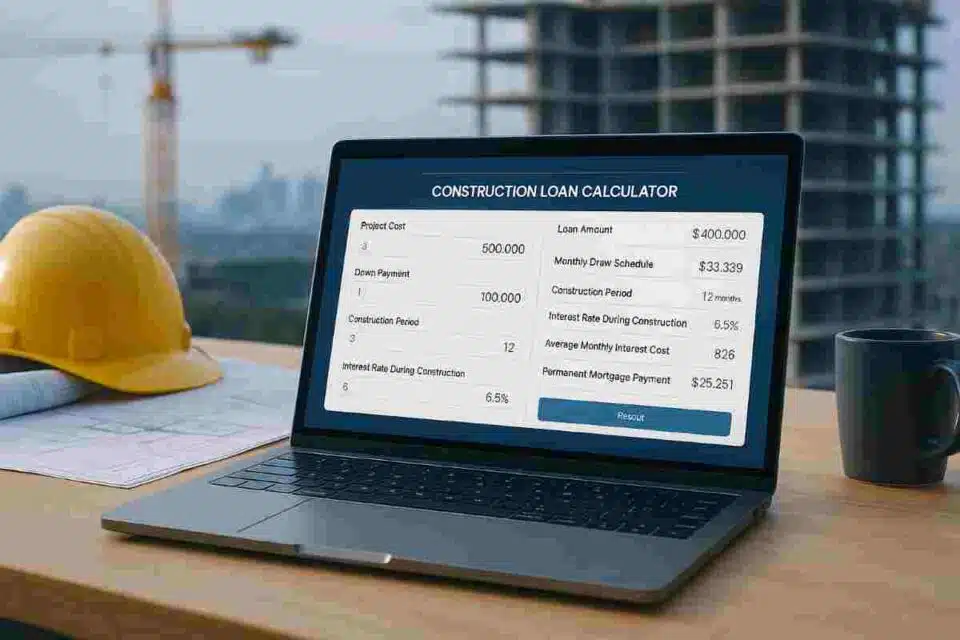

Here is the construction cost calculator to estimate your construction loan costs, total interest, monthly payments, and more.

Use our interactive Construction Loan Calculator to estimate your project loan and payments.

A construction loan calculator is a specialized online tool that helps you estimate the costs of a construction loan. Unlike traditional mortgage calculators, a construction loan calculator factors in the unique aspects of construction financing, such as draw schedules, interest-only periods, and conversion to permanent loans. By entering key details about your project and financing terms, you can get an accurate estimate of your total loan amount, interest paid during construction, and long-term repayment obligations.

Why You Need a Construction Loan Calculator

Building a new home or structure is a significant financial investment. Construction loans are typically more complex than regular home loans, involving multiple stages of funding (draws), interest-only payments during the build, and often converting to a standard mortgage once construction is complete. Here’s why using a construction loan calculator is essential:

- Accurate Budgeting: Understand your monthly payments, total interest, and overall loan costs.

- Compare Loan Offers: Evaluate different lenders’ terms and see how changes in interest rates or construction timelines affect your payments.

- Avoid Surprises: Plan for closing costs, origination fees, and other expenses upfront.

- Confident Decision-Making: Know exactly what you can afford before signing a contract.

How Does a Construction Loan Calculator Work?

A modern construction loan calculator typically requires the following inputs:

- Total Construction Cost: The estimated cost to complete your project, including land, materials, labor, and permits.

- Down Payment: The amount you plan to pay upfront.

- Interest Rate: The annual percentage rate charged by your lender during the construction phase.

- Construction Period: The expected duration of the build, usually in months.

- Draw Schedule: The number of times funds will be disbursed during construction.

- Permanent Loan Terms: The interest rate and length of the mortgage after construction are completed.

- Fees: Estimated closing and origination fees.

Based on these inputs, the calculator estimates:

- Construction Loan Amount: The difference between your total cost and down payment.

- Interest Paid During Construction: Calculated based on the average outstanding balance as funds are drawn.

- Total Amount Financed: Sum of principal, construction interest, and fees.

- Permanent Loan Amount & Monthly Payment: Figures after construction, using standard mortgage amortization formulas.

Step-by-Step Guide: Using a Construction Loan Calculator

- Gather Your Project Details: Know your estimated construction costs, planned down payment, and expected build time.

- Enter Your Data: Use a reliable online construction loan calculator and input your details.

- Review Your Results: Examine the estimated loan amount, total interest, fees, and monthly payments.

- Adjust Scenarios: Change variables like interest rate or loan term to see how they impact your payments.

- Consult with Your Lender: Bring your calculator results to discussions with lenders for more accurate, tailored quotes.

Benefits of Using a Construction Loan Calculator

- Saves Time: Quickly compare multiple financing scenarios.

- Improves Negotiation Power: Understand the numbers before talking to lenders.

- Reduces Risk: Spot potential cash flow issues early.

- Supports Informed Decisions: Choose the best loan structure for your needs.

Tips for Getting the Most Accurate Estimates

- Always use up-to-date interest rates and fees.

- Include all construction-related costs for a realistic loan amount.

- Consider potential delays in the construction period.

- Use calculators that account for multiple draws and changing loan balances during construction.

Frequently Asked Questions

Can I use a construction loan calculator for renovation projects?

Yes! Many construction loan calculators can be used for major renovations, as long as you accurately estimate your total project costs.

Does a construction loan calculator show the final mortgage payment after construction?

A good calculator will show both the interest-only payments during construction and the monthly payments after your loan converts to a permanent mortgage.

Are construction loan calculators free to use?

Most reputable construction loan calculators online are free and easy to use.

Try Our Advanced Construction Loan Calculator

Ready to manage your construction financing? Try our advanced construction loan calculator for detailed estimates, including draw schedules, construction interest, and permanent loan payments. Plan your project with confidence!

Conclusion

A construction loan calculator is an indispensable tool for anyone considering a new build or major renovation. By providing clear, accurate estimates of your financial obligations, it helps you can plan, budget, and negotiate with confidence. Use a construction loan calculator before committing to any builder, lender, or project, and set your construction journey on the path to success.

Related Posts:

- Various Types of Construction Calculators [Updated Guide]

- How Does a Construction Loan Work?

- The Advantages of Hard Money Loans for Real Estate Projects

- Indian Construction Jobs Salary Calculator