Last Updated on September 15, 2025 by Admin

The U.S. construction industry faces unprecedented workforce challenges in 2025, with 246,000 job openings reported by the Bureau of Labor Statistics JOLTS data as of June 2025 and unemployment hovering at 5.4%. Despite achieving record employment of 8.3 million construction workers by July 2024, a staggering 92% of firms report difficulty finding qualified workers, according to the Associated General Contractors’ 2025 workforce survey. This critical shortage—exceeding 501,000 positions industry-wide—has transformed construction recruiting from a commodity service into a strategic necessity for project success.

Construction recruiting agencies now command premium fees, typically 15-35% for direct-hire placements and 40-65% markups for temporary staffing, reflecting the severe talent scarcity affecting everything from skilled trades to executive positions. Average time-to-fill for construction positions remains the fastest across all industries at just 6 days for temporary roles, though management positions stretch to 21-45 days. With the industry maintaining an 8.8-month average construction backlog (ABC Construction Backlog Indicator July 2025), the demand for effective recruiting partners shows no signs of slowing.

This comprehensive analysis evaluates over 20 leading construction recruiters across weighted criteria, including client outcomes, specialization depth, geographic coverage, and compliance programs. Our research, based on verified 2024-2025 data from industry associations, government sources, and company disclosures, provides the definitive guide for contractors seeking recruiting partners who can deliver results in today’s challenging labor market.

Table of Contents

The 2025 Construction Workforce Reality

The construction industry’s workforce shortage has reached critical mass, fundamentally reshaping how companies approach talent acquisition. With construction unemployment at 5.4% as of March 2025—above the national average of 4.3%—the challenge isn’t unemployment but rather a severe skills mismatch. South Dakota reports the lowest construction unemployment at 1.9%, while Rhode Island reaches 16%, highlighting dramatic regional variations that complicate national recruiting strategies.

The Associated Builders and Contractors reports that the industry needs to attract an estimated 501,000 additional workers on top of normal hiring to meet demand in 2025. This shortage occurs despite construction offering competitive wages averaging $38.15 per hour as of mid-2024, with total compensation reaching $48.58 per hour when benefits are included—significantly above many other industries.

For contractors navigating this landscape, understanding construction job profiles and partnering with specialized recruiters has become essential. The most difficult positions to fill include mechanics (83% of firms struggling), cement masons (83%), and plumbers (80%), forcing companies to rethink traditional hiring approaches and invest in comprehensive recruiting partnerships.

Methodology & Ranking Criteria: How We Evaluated Construction Recruiters

Our evaluation employs a weighted scoring system designed to identify recruiters who consistently deliver results in today’s challenging construction labor market. Each firm underwent rigorous assessment across eight core criteria, with data verified through multiple sources, including LinkedIn company analytics, Bureau of Labor Statistics reports, industry association surveys, and third-party review platforms.

Weighted Evaluation

- Client Outcomes: We assessed fill rates, retention statistics, time-to-hire performance, and verified client testimonials. Firms demonstrating consistent placement success with high-paying construction jobs scored highest in this critical category.

- Specialization Depth: Construction industry expertise matters. We evaluated firms’ understanding of specific trades, project types, and emerging niche construction jobs, including BIM specialists, sustainability advisors, and smart infrastructure analysts.

- U.S. Geographic Coverage: Regional presence and local market knowledge proved essential, particularly for firms serving multiple markets or supporting traveling workforce needs.

- Time-to-Fill & Speed: In an industry where construction job openings average 26-42 days to fill, agencies demonstrating faster placement timelines without sacrificing quality earned higher scores.

- Compliance & Safety Programs: OSHA training capabilities, E-Verify usage, and regulatory adherence separated professional agencies from casual staffing providers.

- Candidate Experience: Worker satisfaction ratings, benefits packages, and career development support reflected agencies’ long-term value propositions.

- Verified Reviews/References: Third-party ratings from Glassdoor, Indeed, and Google Reviews provided unbiased performance indicators.

- Scale & Tenure: Years in business, office network size, and financial stability indicated agencies’ ability to weather market fluctuations.

Top 20 U.S. Construction Recruiting Firms:

1. Aerotek Construction Division

Aerotek’s construction division stands as North America’s construction staffing titan, operating from 250+ offices with four decades of specialized experience. Part of Allegis Group, they serve 180,000+ workers annually across 14,000+ employer relationships, making them the go-to partner for large-scale projects requiring rapid workforce mobilization.

- Construction Specialties: Commercial and institutional building, industrial construction, renewable energy projects, public works, heavy civil infrastructure, and the booming data center construction sector driving construction careers in India and globally.

- Roles Covered: From entry-level laborers to specialized trades (framers, masons, ironworkers, glaziers, welders, electricians), plus management positions including construction managers, superintendents, project managers, estimators, and quality control specialists aligned with construction management career paths.

- Service Models: Flexible delivery options including temporary staffing, contract positions, direct hire, and strategic temp-to-hire programs. Their field support teams provide on-site coordination, distinguishing them from remote-only competitors.

- Geographic Reach: True nationwide coverage with 200+ North American offices ensures local market expertise while maintaining corporate consistency and resources.

- Safety & Compliance Excellence: OSHA-compliant safety training programs, comprehensive vetting processes, dedicated field support teams, and full E-Verify compliance protect both workers and clients from regulatory exposure.

- Competitive Advantages: Weekly pay options, flexible payment terms for contractors, comprehensive benefits including medical, dental, vision, and life insurance—critical for attracting quality candidates in today’s market.

2. Tradesmen International

Tradesmen International earned recognition as Construction and Skilled Labor Staffing Agency of the Year 2025, backed by an extraordinary talent pool exceeding 1 million craftworkers. Founded in 1992, they’ve perfected the art of skilled trades staffing through their innovative CORE + Flex workforce strategy.

- Industry Coverage: Commercial and residential construction, heavy industrial projects, energy sector construction including refineries and power plants, shipbuilding, data centers, and wastewater treatment facilities—sectors experiencing rapid growth according to construction industry insights.

- Craftworker Expertise: All skilled trades from apprentice through journeyman levels, including carpenters, electricians, welders, HVAC technicians, and plumbers—positions highlighted among the top construction job profiles.

- Innovative Staffing Model: Their CORE + Flex approach provides permanent W-2 employees for core workforce needs while maintaining flexibility for project-based scaling. This model includes workers’ compensation and unemployment costs, simplifying contractor administration.

- National Reach: Operations in all 50 states with dedicated travel workforce capabilities ensure project support anywhere in the nation.

- Safety Leadership: Safety stands as their #1 core value, demonstrated through mandatory 10-hour OSHA training, monthly skill evaluations, and continuous safety education programs exceeding industry standards.

- Notable Project Portfolio: University of Tampa, Tampa’s Florida Aquarium, Amalie Arena, IKEA Jacksonville, Amazon Distribution Centers, and AT&T Stadium showcase their ability to handle diverse, high-profile projects.

3. PeopleReady Skilled Trades

As a division of TrueBlue (NYSE: TBI), PeopleReady Skilled Trades brings 30+ years of experience and the backing of the nation’s largest light-industrial staffing provider. Serving 650+ markets, they’ve carved a unique niche in renewable energy and infrastructure staffing.

- Sector Specialization: Residential construction (custom homes, multifamily developments), commercial projects (warehouses, data centers), infrastructure (roads, bridges, pipelines), and renewable energy installations—aligning with construction technology careers.

- Trade Coverage: 10+ specialized trades including carpentry, electrical, plumbing, welding, and notably, solar installation expertise supporting 20+ gigawatts of installed capacity.

- Staffing Flexibility: Contract, direct-hire, and temp-to-hire options with their “right-match dispatch” philosophy. All workers are W-2 employees with E-Verify compliance, eliminating classification concerns.

- Geographic Presence: All 50 states with localized market teams understanding regional wage rates, union requirements, and skill availability.

- Specialized Programs: Solar staffing expertise crucial for renewable projects, marine/shipbuilding workforce with 1M+ hours since 2008, and their innovative JobStack app providing on-demand flexibility for workers and contractors alike.

- Major Project Experience: Offshore wind developments, utility-scale renewable energy installations, defense shipbuilding, and commercial marine projects demonstrate their capability in emerging sectors.

4. Hays Construction & Property

Hays Construction & Property brings global recruitment expertise to the U.S. market with 200+ construction-specific recruiters and 150 local market service teams. Their focus on mid-sized firms (50-200 employees) fills a crucial gap for companies lacking internal recruiting infrastructure.

- Project Expertise: High-rise construction, civil engineering, commercial development, infrastructure projects, plus specialized sectors including healthcare, life sciences, and industrial facilities requiring specialized construction careers.

- Professional Placements: Superintendents, project managers, estimators, technical/administrative/finance/HR support roles, and cross-functional leadership positions are essential for modern construction operations.

- Service Offerings: Direct hire, contract-to-hire, temporary staffing, and comprehensive Recruitment Process Outsourcing (RPO) for larger organizations.

- Value-Added Services: 5-10 business-day candidate presentation commitment, DE&I advisory services, Veterans Transition Support Program addressing industry diversity goals.

5. Michael Page Construction

Operating from 8 major market offices, Michael Page Construction fields the largest construction recruiting team in the U.S. with 200+ dedicated recruiters. Their scale enables rapid response to urgent staffing needs while maintaining quality standards.

- Comprehensive Coverage: Full spectrum construction recruiting across all project types and experience levels, from entry-level positions to C-suite executive placements.

- Service Excellence: 5-day average to job offer—industry-leading speed without compromising candidate quality. Their consultative approach, ESG integration, and DE&I focus appeal to progressive contractors.

- Placement Focus: Permanent placement specialization with both retained and contingency search options depending on position level and client needs.

6. Kimmel & Associates

Since 1981, Kimmel & Associates has established itself as North America’s largest industry-specific executive search firm with 60+ specialty executive recruiters. Their Forbes Top 10 “Best Management Consulting Firms” recognition reflects four decades of placement excellence.

- Executive Specialization: General construction, heavy civil, industrial, mechanical/electrical contracting, steel, concrete, renewable energy, and mining sectors—all at executive levels.

- Leadership Placements: Exclusively executive-level positions including project executives, senior superintendents, chief estimators, C-suite executives, VPs, and directors—roles commanding the highest construction salaries.

- Search Methodology: Retained executive search exclusively, employing their comprehensive 43-step placement process ensuring cultural fit and long-term success.

- Geographic Scope: North America-wide coverage with regional market specialization and deep industry relationships.

- Placement Philosophy: Their “sacred responsibility” approach emphasizes extensive vetting and long-term relationship building over transactional placements.

7. The Birmingham Group

Founded in 1967, The Birmingham Group brings unmatched tenure to construction recruiting. Led by Brian Binke with 1,200+ personal placements, they serve companies from $10M revenue to ENR 400 giants, earning recognition as the #1 International Billing Owner in construction.

- Sector Focus: Commercial construction, industrial projects, heavy civil, multifamily developments, healthcare construction, military contracts, and oil & gas projects.

- Management Recruiting: Project managers, superintendents, estimators, engineers, controllers, business development executives, and C-level positions.

- Client Relationships: Direct decision-maker access, 15+ year average client relationships, and their “Dream Team” building philosophy focusing on long-term organizational development.

- Special Programs: Veteran-friendly network supporting military-to-construction transitions, travel-ready candidate database for remote projects.

Additional Leading Construction Recruiters

- GPAC Construction: With 30+ years of experience and 700+ recruiters, GPAC specializes in construction technology integration careers, serving 350+ specialty contractor partners through their technology-enabled platform.

- CyberCoders Construction: Their AI-powered matching technology and 350+ recruiters focus on permanent placements in technical and engineering roles, particularly supporting BIM and digital construction careers.

- NES Fircroft: World-leading engineering staffing with 90+ years of experience, 80+ offices in 45 countries. U.S. operations from Houston, Orlando, and Midland focus on oil & gas, power & renewables, and major infrastructure projects.

- DAVRON: Tampa-based specialist in construction and engineering recruitment with a candidate-focused approach, particularly strong in MEP and technical positions.

- Robert Half: While broader in scope, their construction division excels in financial and administrative roles for construction companies, including CFOs and controllers.

- TruPath Search: 15+ years delivering 10,000+ placements with a partnership-minded approach to mid-level and senior construction professionals.

- Kaye/Bassman Construction: Two decades of experience with 5,000+ mid-to-senior level searches, serving Fortune 500 construction clients.

- Building Team Solutions: Austin-based national placement specialist for tradesmen, affiliated with Texas Association of Staffing.

- Wide Effect: Global talent solutions with 50-state recruiter network, specializing in maritime and heavy construction.

- Labor Finders: 200+ locations providing day laborers and temporary construction support for immediate needs.

- Elite Force Staffing: Veteran-owned firm offering tailored construction staffing solutions with military precision and values.

Category Winners by Specialization

Skilled Trades Staffing (Temporary/Temp-to-Hire)

- Tradesmen International – Unmatched 1M+ craftworker database, comprehensive 50-state coverage, innovative CORE + Flex strategy

- PeopleReady Skilled Trades – 650+ market presence, JobStack app innovation, renewable energy expertise

- Aerotek Construction – 250+ office network, comprehensive benefits, dedicated field support teams

- Labor Finders – 200+ locations for immediate day labor needs, on-demand workforce solutions

- Building Team Solutions – National tradesmen placement, Texas Association of Staffing affiliation

Direct-Hire Professional & Management

- Michael Page Construction – 200+ dedicated recruiters, 5-day average offer timeline, 8 major market offices

- Hays Construction & Property – DE&I advisory services, Veterans Transition Support, mid-market specialization

- GPAC Construction – 350+ specialty contractor partnerships, technology platform integration

- CyberCoders Construction – AI-powered matching technology, rapid turnaround, permanent placement focus

- TruPath Search – 10,000+ successful placements, partnership approach, 15+ years experience

Executive Search (C-Suite, VP, Directors)

- Kimmel & Associates – Industry’s largest executive search firm, 43-step placement process, 40+ years of excellence

- The Birmingham Group – 1,200+ executive placements, ENR 400 client base, 15+ year client relationships

- Kaye/Bassman Construction – 5,000+ mid-to-senior searches, Fortune 500 clients, 20+ years expertise

- Hornberger Management (HMC) – 25+ years board member and senior executive specialization

- Robert Half – CFO/controller specialty for construction companies, established brand recognition

Heavy Civil & Infrastructure Specialists

- NES Fircroft – Global infrastructure expertise, Employer of Record services, major project capabilities

- Aerotek Construction – Heavy civil specialization, public works experience, land development expertise

- PeopleReady Skilled Trades – Infrastructure focus spanning roads, bridges, pipelines, airports

- Tradesmen International – Heavy industrial construction, power plants, wastewater treatment

- Wide Effect – Maritime and heavy construction specialization, coastal project expertise

MEP/BIM/VDC Specialists

- GPAC Construction – BIM specialist placements, electrical positions, technology-focused recruiting

- CyberCoders Construction – Technical and engineering support, manufacturing integration capabilities

- DAVRON – CAD drafters/designers, HVAC specialists, plumbing/fire protection expertise

- Michael Page Construction – Technical role expertise, consultative placement approach

- Robert Half – IT support roles for construction firms, technology integration specialists

Comprehensive Pricing & Service Comparison Tables

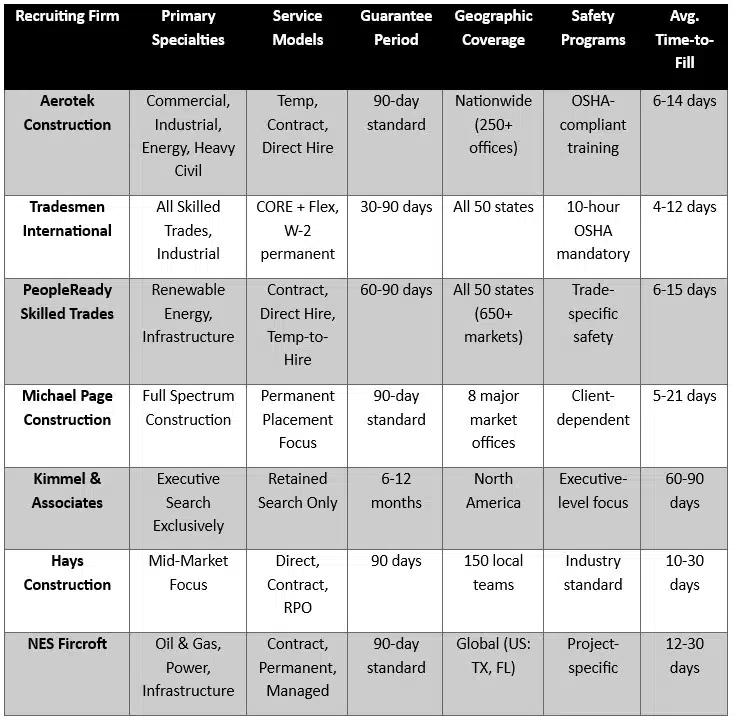

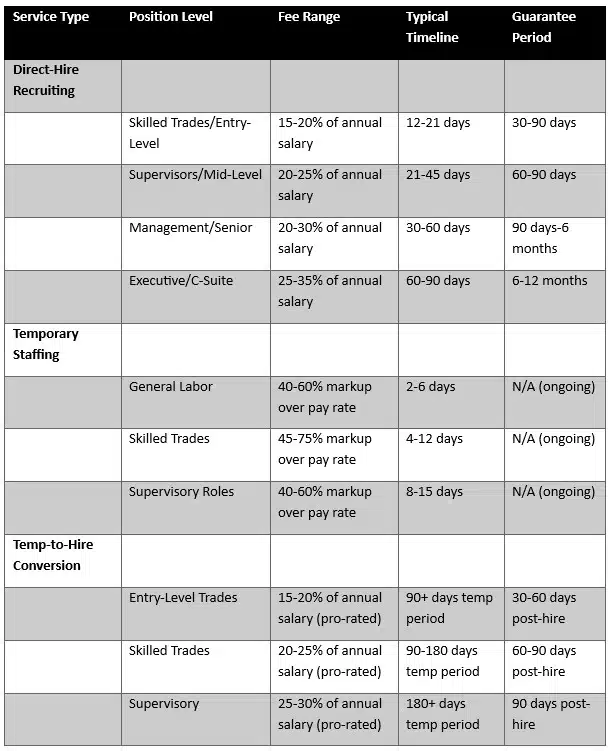

Table A: Construction Recruiter Service Comparison

Table B: Construction Recruiting Pricing Benchmarks

Source: Recruiting agency fee structures and staffing markup rates analysis, 2024-2025 market data

U.S. Construction Market Snapshot: 2024-2025 Trends

Critical Workforce Shortage Intensifies

The construction industry’s labor crisis has reached unprecedented levels, with JOLTS data showing 246,000 open positions as of June 2025—a 2.9% job opening rate that remains stubbornly elevated despite economic uncertainties. This shortage occurs alongside record employment of 8.3 million payroll workers, highlighting that the issue isn’t a lack of jobs but rather severe skills mismatches and demographic challenges.

The AGC’s 2025 workforce survey of 1,400 construction firms reveals the depth of the crisis: 92% of firms report difficulty finding qualified workers, with 88% having current openings for craft positions. The most challenging positions to fill include mechanics (83% of firms struggling), cement masons (83%), plumbers (80%), and carpenters (72%)—core trades essential for project completion.

Project Impacts and Economic Consequences

Labor shortages are causing tangible project impacts: 45% of contractors report delays due to workforce constraints, while 28% of firms have been affected by immigration enforcement actions in the past six months. These disruptions occur despite the industry maintaining its highest backlog in years at 8.8 months according to ABC’s Construction Backlog Indicator, suggesting strong demand that the industry cannot fully capitalize on due to labor constraints.

The economic impact extends beyond individual projects. FMI Consulting projects only 2% construction spending growth for 2025 after 5.4% in 2024, partially attributed to labor-constrained capacity. Meanwhile, Dodge Construction Network predicts 8.6% growth in construction starts dollar volume, driven by federal infrastructure investments that may further strain workforce availability.

Wage Growth and Compensation Pressures

Construction wages increased 2.3% year-over-year to $38.15/hour by mid-2024, reflecting tight labor markets. Total construction compensation reached $48.58/hour (BLS Employment Cost Index), with benefits comprising 30.5% of total costs, including $4.16/hour for workers’ compensation—significantly above the all-industries average.

Regional variations are dramatic: construction workers in San Francisco average $52.30/hour while those in rural markets may earn $28.50/hour for similar work. These disparities complicate national recruiting strategies and drive increased labor mobility, with traveling workers commanding premium rates.

Technology Adoption and Future Workforce

The construction industry’s digital transformation is reshaping workforce requirements. Construction technology integration now represents one of the fastest-growing career segments, with BIM managers, drone operators, and construction software specialists commanding premium salaries. Companies investing in technology report 15-25% productivity gains, partially offsetting labor shortages.

Educational institutions are responding with specialized programs, though graduation rates lag industry needs by an estimated 3:1 ratio. Trade schools report 100% placement rates for graduates, with many students receiving multiple job offers before completing programs.

Regional Employment Patterns

Geographic disparities in construction employment growth reveal an uneven recovery. Only 51% of metro areas added construction jobs in the 12 months through July 2025. Arlington-Alexandria-Reston, Virginia led gains with 7,900 new jobs (+9%), driven by data center construction and federal projects. Conversely, Riverside-San Bernardino, California, lost 7,200 jobs (-6%), reflecting California’s challenging regulatory environment.

The South maintains the longest construction backlog regionally at 9.2 months, while the West shows the strongest backlog growth trends. Alaska, Hawaii, and Nevada lead in construction job growth rates, with 40 states overall reporting increased construction employment through 2024.

How to Choose the Right Construction Recruiter: Essential Evaluation Criteria

Selecting an effective construction recruiting partner requires systematic evaluation across multiple dimensions. The stakes are high—the wrong choice can result in project delays, safety incidents, and significant financial losses. Use this comprehensive framework to identify agencies aligned with your specific needs and standards.

Critical Evaluation Questions for Recruiting Partners

1. Industry Specialization and Track Record What percentage of your placements are in construction? Request specific examples of similar projects (commercial, heavy civil, industrial, renewable energy). Agencies should demonstrate deep understanding of your sector’s unique requirements, from technical skills to safety protocols. Look for recruiters who understand emerging construction careers in technology and sustainability.

2. Geographic Coverage and Local Market Knowledge Do you maintain local recruiters familiar with our regional market conditions, prevailing wage rates, and available talent pools? Can you source workers willing to travel or relocate? Local presence matters—recruiters should understand state-specific licensing requirements, union territories, and regional wage variations.

3. Safety and Compliance Programs What OSHA training do you provide? How do you verify worker certifications and maintain compliance records? Safety remains paramount in construction. Legitimate agencies provide documented safety training, maintain certification databases, and understand joint employer responsibilities under OSHA regulations.

4. Worker Classification and Legal Compliance Are your workers W-2 employees or 1099 contractors? How do you ensure compliance with Department of Labor classification requirements? Misclassification represents significant legal risk—legitimate agencies classify construction workers as W-2 employees and maintain proper documentation.

5. Background Screening and Verification What background checks do you perform? Do you conduct drug testing and skills assessments? How do you handle E-Verify requirements? Comprehensive screening should include criminal background checks, employment verification, skills testing, drug screening, and I-9/E-Verify compliance.

6. Performance Metrics and Guarantees What are your average placement timelines by position type? What guarantee periods do you offer? Request specific metrics: fill rates, time-to-fill by role, retention rates, and client satisfaction scores. Top agencies provide 30-90 day guarantees for permanent placements.

7. Technology and Communication Systems How do you track candidate progress? What reporting do you provide? Do you offer online portals or mobile apps? Modern agencies leverage technology for candidate tracking, client communication, and workforce management.

8. Financial Stability and Insurance Coverage How long have you been in business? Can you provide proof of general liability and workers’ compensation coverage? Request financial references and verify proper insurance coverage protecting against workplace injuries and liability claims.

Red Flags: Warning Signs to Avoid

Immediate Disqualifiers:

- Cannot provide specific construction industry references or case studies

- Offer suspiciously low fees suggesting corner-cutting on screening or compliance

- Claim to provide 1099 contractors for construction work (likely misclassification)

- Lack proper state licensing for PEO or employment agency operations

- No formal safety training programs or OSHA compliance documentation

- Promise unrealistic placement timelines without understanding requirements

- Cannot provide workers’ compensation or liability insurance certificates

- Use high-pressure sales tactics or demand exclusive long-term contracts

- Consistently poor online reviews citing safety issues or unpaid wages

- Cannot demonstrate knowledge of local wage rates or regulations

Best Practices for Agency Partnership Success

- Start with Pilot Projects: Test agency performance with smaller assignments before committing to larger contracts. Evaluate their screening quality, communication responsiveness, and candidate caliber during initial engagements.

- Establish Clear Expectations: Document safety requirements, compliance obligations, and performance metrics in service agreements. Define communication protocols, reporting requirements, and escalation procedures upfront.

- Maintain Multiple Relationships: Diversify recruiting partnerships to ensure coverage during peak demand and maintain competitive pricing. Different agencies may excel in different trades or geographic regions.

- Monitor Performance Continuously: Request monthly reports on key metrics including time-to-fill, retention rates, safety incidents, and client satisfaction. Address issues promptly before they impact projects.

- Invest in Strategic Partnerships: Consider long-term agreements with proven performers who demonstrate consistent quality, understand your culture, and align with your values.

Sample RFP Template for Construction Recruiting Services

Email Template for Initial Recruiter Engagement

Subject Line: RFP: Construction Staffing Services – [Company Name] – [Location/Project]

Dear [Recruiter Name],

[Company Name] seeks qualified construction recruiting partners for upcoming projects and ongoing staffing needs. We’re evaluating agencies for potential partnership based on demonstrated construction industry expertise and proven performance.

Company Background:

- [Brief company description]

- [Annual revenue/project volume]

- [Geographic markets served]

- [Typical project types]

Immediate Staffing Needs:

- [List specific open positions with quantities]

- [Required start dates]

- [Project locations]

- [Special certifications or requirements]

- [Union/non-union specifications]

Information Requested:

1. Company Profile:

- Years serving the construction industry

- Number of construction-dedicated recruiters

- Office locations and coverage areas

- Annual construction placement volume

- Three recent client references (with permission to contact)

- Insurance certificates (GL and WC)

2. Service Capabilities:

- Construction roles you regularly fill

- Average time-to-fill by position level

- Temporary, temp-to-hire, and direct-hire options

- Candidate screening and assessment processes

- Safety training and certification programs

- Technology platforms and reporting capabilities

3. Pricing Structure:

- Direct-hire fees by position level

- Temporary staffing markup rates

- Temp-to-hire conversion terms

- Payment terms and invoicing procedures

- Volume discounts or preferred client programs

- Guarantee periods and replacement policies

4. Compliance Programs:

- Worker classification practices (W-2 vs 1099)

- E-Verify and I-9 procedures

- Background check and drug testing protocols

- OSHA training and safety programs

- State licensing and certifications

- Davis-Bacon/prevailing wage experience

5. Proposed Approach:

- Recruiting strategy for our open positions

- Timeline for initial candidate presentations

- Account management structure

- Communication and reporting protocols

- Performance metrics and success measures

Submission Requirements: Please provide responses addressing all points above, along with:

- Sample service agreement

- Company capabilities brochure

- Case studies from similar projects

- Proposed timeline for filling current openings

Evaluation Process: We will evaluate submissions based on:

- Construction industry expertise (30%)

- Service capabilities and coverage (25%)

- Pricing competitiveness (20%)

- Compliance and safety programs (15%)

- References and track record (10%)

Responses due by [date]. We plan to select 2-3 preferred partners for ongoing collaboration.

Thank you for your interest in partnering with [Company Name].

Best regards, [Your Name] [Title] [Company] [Contact Information]

Compliance & Risk Management in Construction Staffing

Worker Classification: The Critical Compliance Issue

The Department of Labor’s 2024 Independent Contractor Rule applies the “economic reality” test to determine proper classification. For construction workers, multiple factors virtually always point to employee status: work is integral to the employer’s business, the employer controls work methods and scheduling, workers lack independent business operations, and the relationship is indefinite or project-length.

Critical compliance point: Legitimate construction staffing agencies provide workers as W-2 employees, not 1099 contractors. Agencies claiming to provide independent contractors for construction work should be avoided—misclassification can result in back wages, benefits, penalties up to $25,000 per violation, and personal liability for company officers.

Davis-Bacon and Prevailing Wage Compliance

Federal construction contracts exceeding $2,000 trigger Davis-Bacon Act requirements. Recent regulatory changes (October 2023) expanded coverage and returned to the “30% rule” for wage determinations. Key requirements include:

- Paying locally prevailing wages, including fringe benefits

- Weekly certified payroll submission (Form WH-347)

- Posting wage determinations and Davis-Bacon posters at worksites

- Maintaining detailed payroll records for three years

- Ensuring subcontractor compliance throughout the project

Many states maintain separate prevailing wage laws for state-funded projects. California’s requirements are particularly stringent, requiring certified payroll submission through the DIR’s online portal.

Immigration Compliance and E-Verify Requirements

Form I-9 completion is mandatory for all employees within three business days of hire. Staffing agencies must complete I-9s for temporary workers and maintain forms for three years after hire OR one year after termination (whichever is longer).

E-Verify requirements vary significantly:

- Federal contractors must use E-Verify for covered contracts

- States with mandatory E-Verify for almost all/most employers: Arizona, Georgia, Mississippi, South Carolina, Alabama, Utah, Florida (25+ employees)

- Public construction projects often require E-Verify regardless of state mandates

State Licensing and Regulatory Requirements

Professional Employer Organization (PEO) licensing is required in Texas, Florida, Arkansas, Nevada, and New Hampshire. Requirements typically include:

- Surety bonds ($100,000-$250,000)

- Audited financial statements

- Application fees ($500-$5,000)

- Annual renewal obligations

Employment agency licensing varies by state. Massachusetts requires both employment agency licensing AND staffing agency registration. New York mandates employment agency licensing. Many states have no licensing requirements, though local ordinances may apply.

Risk Mitigation Best Practices

Immediate Actions:

- Verify proper worker classification using federal and state tests

- Review safety agreements addressing OSHA joint employer requirements

- Confirm licensing compliance in each operating state

- Audit I-9 and E-Verify processes for all placements

- Implement Davis-Bacon payroll systems for covered projects

Long-term Compliance Program:

- Subscribe to regulatory updates from DOL, OSHA, and the American Staffing Association

- Maintain comprehensive compliance documentation

- Update client contracts annually for regulatory changes

- Train staff regularly on classification and safety requirements

- Establish incident response procedures for investigations

Conclusion: Navigating the Construction Recruiting Landscape

The construction industry’s workforce crisis demands strategic recruiting partnerships. With 501,000+ workers needed and 92% of firms struggling to find qualified talent, selecting the right recruiting agency can determine project success or failure. The firms profiled in this guide—from industry giants like Aerotek and Tradesmen International to specialized firms like Kimmel & Associates—offer proven solutions for different needs and budgets.

Success requires understanding your specific requirements, thoroughly vetting potential partners, and establishing clear expectations from the start. Whether you need temporary laborers for a rush project, skilled trades for long-term assignments, or executive talent to lead your organization, the right recruiting partner exists.

For job seekers navigating this landscape, explore opportunities on ConstructionPlacements.com where leading recruiters post positions daily. Take advantage of our construction career resources to position yourself for success in this dynamic industry.

The construction workforce shortage won’t resolve quickly—demographic trends and training pipeline limitations ensure continued challenges through 2030 and beyond. Companies that build strong recruiting partnerships now will maintain competitive advantages as the industry evolves. Choose wisely, monitor performance continuously, and invest in relationships that deliver long-term value.

Related Posts:

- Best Recruitment Strategies For Construction Companies

- What Recruiters Look For in Construction Resumes

- Construction Recruitment Agencies: Everything You Need to Know

- How to Get Your First Construction Job Through LinkedIn in 2025

Fees vary significantly based on service type and position level. Direct-hire recruiting fees typically range from 15-35% of first-year salary: skilled trades command 15-20%, management roles 20-30%, and executive positions 25-35%. These fees reflect the challenging construction job market and specialized expertise required. Temporary staffing markups range from 40-65% over the worker’s hourly rate, with specialized trades commanding higher markups. This covers the agency’s costs for recruiting, screening, payroll processing, benefits, workers’ compensation, unemployment insurance, and profit margin. Understanding staffing agency markup calculations helps evaluate pricing fairness.

Construction maintains the fastest fill times across all industries due to agencies’ established talent pipelines. Temporary positions average just 6 days from request to placement, while skilled trades require 12-21 days. Management roles typically take 21-45 days, and executive positions require 60-90 days for comprehensive vetting.

Rush placements are often possible for additional fees, particularly for agencies with strong local networks. However, expedited timelines shouldn’t compromise screening quality—proper vetting prevents costly mistakes and safety incidents.

Contingent search operates on a “no placement, no fee” basis, with payment due only upon successful hire. Fees typically range from 15-25% of annual salary. This model works well for positions under $100,000 where multiple qualified candidates exist.

Retained search requires upfront payment, usually structured as one-third upon engagement, one-third at candidate slate presentation, and one-third upon placement. Fees range from 25-35% of annual compensation. This model suits executive searches and hard-to-fill positions requiring dedicated resources.

Standard guarantee periods vary by position level and fee structure. Most agencies offer 30-90 day guarantees for permanent placements, with executive positions often including 6-12 month guarantees. During the guarantee period, agencies typically provide free replacement candidates if the original hire doesn’t work out.

Some agencies offer pro-rated refunds instead of replacements, particularly for retained searches. Premium guarantee periods command higher fees but provide additional security for critical positions. Always clarify guarantee terms including what constitutes a valid claim and any client obligations.

Most major construction staffing firms work with both union and non-union talent pools, though capabilities vary by region and agency. In strong union markets, agencies must maintain relationships with local halls and understand collective bargaining agreements. For Davis-Bacon and prevailing wage projects, agencies must ensure compliance regardless of union status.

When evaluating agencies, ask about their experience with your specific labor requirements. Some agencies excel in non-union markets, while others have strong union relationships enabling access to skilled journeymen during peak demand.

Temp-to-hire programs typically require 90+ days (500-600 hours) before conversion eligibility. This trial period allows mutual evaluation before permanent commitment. Conversion fees usually range from 15-30% of annual salary, often reduced by credits for hours already worked.

Success rates are high in construction—65-80% of temp-to-hire arrangements result in permanent employment due to the tight labor market. Some agencies offer free conversion after extended temporary periods (typically 12 months) or sliding scale fees based on tenure.

Comprehensive screening protects projects from unqualified or problematic workers. Standard screening includes criminal background checks (typically 7 years), employment verification, education/certification validation, drug testing (pre-employment and random), driving record checks (for equipment operators), and skills assessments.

For sensitive projects (schools, hospitals, government facilities), additional screening may include sex offender registry checks, financial background reviews, and security clearances. All workers must complete I-9 employment eligibility verification, with many projects requiring E-Verify confirmation.

Both parties share responsibility under OSHA’s joint employer doctrine. Staffing agencies must provide general safety training, verify basic certifications, ensure workers understand hazards, and maintain training documentation.

Host employers must provide site-specific training, job-specific hazard communication, necessary personal protective equipment, and equal treatment with regular employees. Written agreements should clearly delineate training responsibilities to prevent gaps that could result in injuries or OSHA citations.