Last Updated on July 29, 2025 by Admin

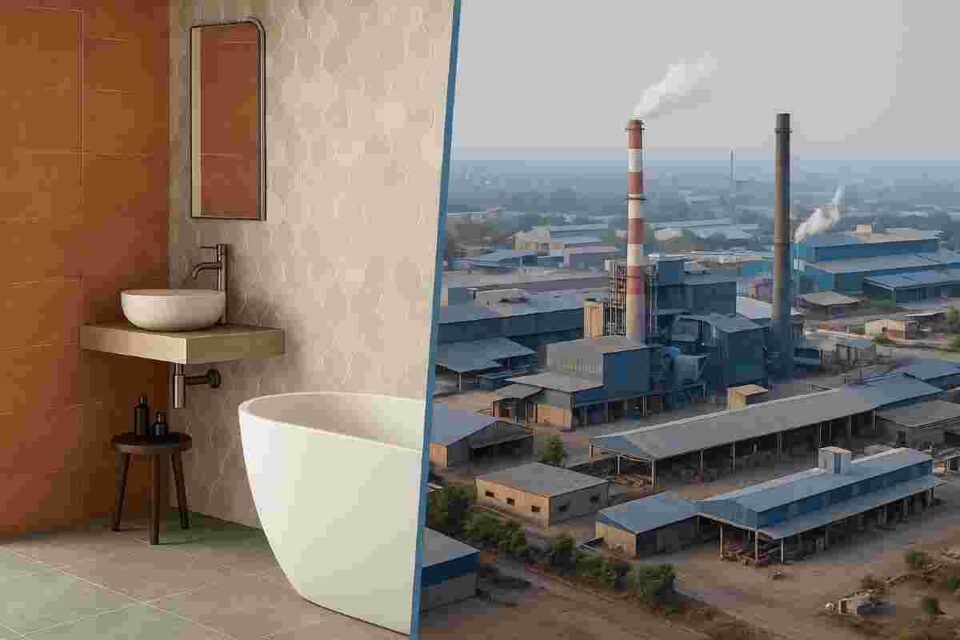

India’s ceramic tiles industry has emerged as a global powerhouse, becoming the world’s second-largest tile producer and leading exporter. With the market valued at $10.45 billion in 2025 and projected to reach $19.71 billion by 2030, the top 10 tiles company in India are reshaping both domestic and international markets through innovation, quality, and strategic expansion.

ConstructionCareerHub App is LIVE — built ONLY for construction careers. Don’t apply with a weak resume.

Get ATS-ready Resume Lab + Interview Copilot + Campus Placement Prep (resume screening, skill gaps, interview readiness) — in minutes & Other advanced features.

Explore Smarter Construction Career Tools →Quick check. Big impact. Start now.

This comprehensive guide explores the leading tiles manufacturing company in India, analyzing their market positioning, product portfolios, and growth strategies that define the industry landscape. From established giants to emerging players, we’ll uncover what makes these companies the best tiles company in India for consumers and investors alike.

Table of Contents

Understanding India’s Tile Industry Landscape

The Indian tile industry represents one of the world’s most dynamic manufacturing sectors, with Morbi, Gujarat serving as the epicenter of global tile production. Housing over 800 factories that produce 90% of India’s tiles, Morbi has earned its reputation as the ceramic capital of the world.

The industry’s export performance particularly showcases India’s global competitiveness. In 2023, India exported 589.5 million square meters of ceramic tiles, representing a remarkable 39.6% increase over 2022, with export revenue reaching €2.25 billion.

Market Structure and Growth Drivers

The tiles market in India demonstrates sophisticated consumer preferences across multiple categories:

- Ceramic tiles dominate the traditional segment

- Vitrified tiles represent the fastest-growing premium category

- Porcelain tiles command 39% market share in premium segments

- Natural stone alternatives constitute specialized luxury offerings

Key growth drivers include rapid urbanization, government infrastructure projects, rising disposable incomes, and increasing preference for premium home improvement solutions.

Top 10 Tiles Company in India: Market Leaders Analysis

1. Kajaria Ceramics – India’s Undisputed Tile Leader

Kajaria Ceramics maintains its position as the top tiles company in India, generating ₹4,578 crores in revenue during 2024. With a production capacity of 93.10 million square meters annually across nine plants in India and one in Nepal, Kajaria demonstrates unmatched scale and efficiency.

Key Strengths:

- Market capitalization of ₹19,669 crores (July 2025)

- Industry-leading 7.75% PAT margin

- Distribution network spanning 70,000+ partners

- Advanced automation and robotic applications

The company’s success stems from its commitment to technological innovation, quality manufacturing, and extensive distribution reach, making it the preferred choice for both residential and commercial projects.

2. Somany Ceramics – The Father of Ceramics in India

Known as the “Father of Ceramics in India,” Somany Ceramics secures the second position with ₹2,605 crores in revenue and 75 million square meters annual capacity across 11 state-of-the-art facilities.

Market Position:

- Network of 500+ exclusive showrooms

- 15,000+ dealers nationwide

- Export presence in 80+ countries across six continents

- Recent “Embrace the Extraordinary” luxury collection launch

Somany’s legacy spans decades, building trust through consistent quality and innovative designs that cater to evolving consumer preferences.

3. Asian Granito India Limited (AGL) – The Innovation Pioneer

Asian Granito represents rapid growth with an estimated revenue of ₹1,347 crores and 54.4 million square meters of production capacity. The company has demonstrated remarkable 40x capacity growth since 2000, positioning itself as a technology pioneer in large format tiles.

Innovation Leadership:

- Operations spanning 100+ countries

- Network of 1,350+ direct dealers

- Pioneer in large format tile technology

- Recent introduction of 60+ new kitchen and bathroom products

4. H&R Johnson India – Premium Design Excellence

H&R Johnson India generates ₹699 crores quarterly revenue with 67 million square meters capacity across 11 plants. The company focuses on premium design excellence and comprehensive tile solutions.

Competitive Advantages:

- Leading premium and designer tiles brand

- Strong architectural and designer network

- Comprehensive product portfolio

- Advanced manufacturing capabilities

5. RAK Ceramics India – Global Expertise, Local Excellence

RAK Ceramics India operates one of India’s most modern facilities with 30,000 square meters daily production capacity. The company leverages global expertise to serve the Indian market with world-class products.

Market Differentiation:

- Global technology and design standards

- Focus on porcelain and premium segments

- Modern manufacturing infrastructure

- International quality certifications

6. Orientbell Tiles – Technology and Innovation Leader

Orientbell Tiles generates ₹1,854 crores in revenue with four patented technologies, targeting ₹2,500-2,600 crores in the current fiscal projections. The company emphasizes technology-driven consumer experiences.

Innovation Features:

- Four patented manufacturing technologies

- “TriaLook” AR/VR visualization tools

- Digital customer engagement platforms

- Focus on sustainable manufacturing

7. Nitco Limited – Heritage Meets Innovation

Nitco Limited leverages its status as India’s oldest tile manufacturer (established 1953) to offer premium tiles and marble solutions with triple reinforcement technology.

Legacy Strengths:

- 70+ years of manufacturing excellence

- Premium designer tiles and marble collections

- Strong architectural specification network

- Heritage brand trust and recognition

8. Simpolo Vitrified – Vitrified Tiles Specialist

Simpolo Vitrified specializes in premium vitrified tiles with 40 million square meters capacity, known for near-zero water absorption and superior durability.

Specialization Focus:

- Top 10 vitrified tiles brands in India positioning

- Near-zero water absorption technology

- High-traffic commercial applications

- Premium residential collections

9. Sunwin Ceramica – Emerging Market Leader

Sunwin Ceramica has emerged as a significant player since 2014 with 20,000 square meters daily capacity, particularly strong in glazed vitrified tiles.

Growth Strategy:

- Focus on premium glazed vitrified tiles

- Rapid capacity expansion

- Technology-driven manufacturing

- Strategic market positioning

10. Spenza Ceramics – Design Innovation Leader

Spenza Ceramics showcases innovation leadership through 7,000+ designs in 22+ sizes, demonstrating the creative potential in modern tile manufacturing.

Design Excellence:

- Extensive design portfolio

- Multiple size offerings

- Innovation in digital printing

- Creative market positioning

Regional Market Dynamics and Consumer Preferences

Understanding regional preferences is crucial for a ceramic tiles company in India’s success. Market research indicates distinct regional characteristics:

North India Market

- 35% of national demand

- Highest disposable income levels

- Premium tile preferences

- 20-30% price premiums accepted for quality

West India Production Hub

- Gujarat dominates production through Morbi

- ₹20,000+ crore industrial investment

- 600,000+ direct and indirect jobs

- Export hub to 163 countries

South India Quality Focus

- Quality-conscious purchasing behavior

- Preference for traditional-contemporary fusion

- Growing eco-friendly tile demand

- Strong commercial sector consumption

East India Emerging Potential

- Kolkata as primary demand center

- Odisha’s industrial growth driving demand

- Infrastructure development opportunities

- Government project acceleration

Product Categories and Market Segmentation

The best tiles company in India succeed by mastering multiple product categories:

Ceramic Tiles Market

Traditional ceramic tiles maintain strong demand with digital printing revolutionizing design possibilities. Leading companies offer:

- Basic designs: ₹30-50 per square foot

- Premium collections: ₹300+ per square foot

- Anti-bacterial properties

- 3D textured surfaces

Vitrified Tiles Premium Segment

The top 10 vitrified tiles brands in India focus on:

- Superior durability and water resistance

- Commercial high-traffic applications

- Pricing: ₹40-80 per square foot (standard) to ₹200-400+ (designer)

- Advanced technologies like Continua+ and nano-sealing

Porcelain Tiles Luxury Category

Porcelain tiles command significant market share with:

- $2.59 billion market value in 2024

- Luxury residential and commercial preference

- Large format slabs up to 120x240cm

- Pricing: ₹80-150 per square foot to ₹200-500+ premium

Industry Trends and Future Outlook

The Indian tile industry demonstrates several transformative trends:

Technological Innovation

- Large format tiles (80x120cm to 240x120cm) gaining acceptance

- Digital printing technology enables unlimited design possibilities

- AI-driven design patterns

- Smart surface technologies (self-cleaning, air-purifying)

Sustainability Focus

Post-COVID consciousness drives demand for:

- Eco-friendly manufacturing processes

- Anti-bacterial and anti-viral coatings

- Recycled material tiles

- Energy-efficient production methods

Market Expansion Opportunities

- Rural market potential: 0.50 sq.m per capita vs 2.6 sq.m urban

- Export diversification beyond traditional markets

- Africa is showing 68.8% volume growth

- Europe is demonstrating 75% growth in 2023

Digital Transformation

Companies investing in:

- AR/VR visualization tools

- Mobile applications for product browsing

- Omnichannel customer experiences

- Online-to-offline integration strategies

Consumer Buying Patterns and Decision Factors

Understanding consumer behavior helps identify why certain companies become the top tile brands in India:

Research and Purchase Journey

- 70% research online before store visits

- Offline purchases dominate due to tactile selection needs

- 2-4 weeks research timeline

- Visit 3-5 stores for comparison

- 1-2 weeks decision-making period

Influence Factors

- Architects influence 40% of premium segment decisions

- Contractors drive 35% of bulk purchases

- Brand trust and recognition

- Installation service quality

- Price-value perception

B2B vs B2C Dynamics

Commercial Segment (31% of market):

- Cost efficiency focus

- Technical specifications priority

- Delivery timeline adherence

- Bulk pricing structures

Residential Segment (69% of market):

- Emotional decision-making

- Aesthetic appeal priority

- Brand trust importance

- Comprehensive service expectations

Related Posts:

- Stylish and Affordable Flooring Trends that will Define Interiors in 2025

- A Comprehensive Guide to Selecting Engineered Wood Flooring for Your Home

- Opportunities and Training for Flooring Installers

- What’s the Difference Between Engineered Wood Flooring and Hardwood Flooring

Export Performance and Global Competitiveness

India’s position as a leading tile exporter strengthens the top 10 tile companies in India:

Export Statistics 2023

- 589.5 million square meters exported (+39.6% growth)

- €2.25 billion export revenue (+28.2% growth)

- Asia maintains 42.3% of the export volume

- Africa emerged as the second-largest region (+68.8% growth)

- European Union showed 75% growth

Key Export Destinations

- USA: Leading market

- UAE: Second position

- Mexico: +128% growth

- Russia: +127.7% growth

- Israel: +145.6% growth

Investment and Manufacturing Infrastructure

The tiles manufacturing company in India benefit from robust infrastructure:

Production Capacity

- 1,214.67 million square meters total capacity (2024)

- Morbi cluster: 800+ factories

- Modern automation and robotics

- Zero-error manufacturing systems

Technology Adoption

- Digital printing becoming standard

- Large format tile production capabilities

- Sustainable manufacturing practices

- Advanced quality control systems

Challenges and Strategic Responses

Leading ceramic tiles manufacturers India address multiple challenges:

Market Challenges

- Raw material cost volatility

- Gas price fluctuations affecting profitability

- Environmental compliance requirements

- International trade barriers (41% anti-dumping duty by GCC)

Strategic Responses

- Geographic market diversification

- Technology advancement investments

- Operational excellence focus

- Sustainable practice adoption

Future Market Projections and Opportunities

The Indian tile industry outlook remains highly positive:

Growth Projections

- Market size: $10.45 billion (2025) to $19.71 billion (2030)

- 13.54% CAGR projected growth

- Organized sector consolidation continuing

- Rural market expansion potential

Emerging Opportunities

- Smart city development projects

- Government housing schemes

- Infrastructure development initiatives

- Green building certification demand

Conclusion: Choosing the Right Tile Company

The top 10 tiles company in India represent excellence in manufacturing, innovation, and market service. Whether you’re a consumer seeking quality tiles for your home or a business requiring commercial solutions, these companies offer comprehensive options across all price points and applications.

Kajaria Ceramics leads through operational excellence and market reach, while companies like Somany and Asian Granito offer heritage and innovation respectively. For specific requirements like vitrified tiles, the top 10 vitrified tiles brands in India provide specialized solutions with advanced technology and superior performance.

The industry’s continued growth, technological advancement, and global competitiveness ensure that these leading companies will continue evolving to meet changing market demands while maintaining their positions as the best tiles company in India.

When selecting tiles for your project, consider factors like application requirements, budget constraints, design preferences, and long-term durability needs. The top ten tiles company in India featured in this guide offer the quality, service, and innovation necessary for successful tile installations across residential, commercial, and industrial applications.

For the latest updates on India’s tile industry and company performance, consult official company websites and industry reports for current product catalogs, pricing, and availability information.

Related Posts:

- Determining Commercial Property Insurance Costs

- Should You Use Tiles on Your Rooftop?

- How to Create a Culture of Safety on Construction Sites

- Who Pays for Builders’ Risk Insurance? Key Answers

- Highest Paying Construction Jobs in the US [2025 Updated]

FAQs

Kajaria Ceramics is India’s leading tiles company with ₹4,578 crores revenue in 2024 and 93.10 million square meters annual production capacity. Other top companies include Somany Ceramics (₹2,605 crores revenue), Asian Granito (₹1,347 crores), H&R Johnson India, and RAK Ceramics India, collectively dominating the ₹10.45 billion Indian tile market.

India’s ceramic tiles market is valued at $10.45 billion in 2025 and projected to reach $19.71 billion by 2030, growing at 13.54% CAGR. India is the world’s second-largest tile producer with 1,214.67 million square meters production capacity, exporting 589.5 million square meters worth €2.25 billion in 2023.

Indian manufacturers produce four main tile categories: Ceramic tiles (traditional segment with digital printing), Vitrified tiles (premium category with superior durability), Porcelain tiles (39% market share in luxury segment), and Natural stone alternatives (specialized premium offerings). Leading companies like Kajaria, Somany, and Asian Granito manufacture across all categories.

Morbi, Gujarat is India’s ceramic capital, housing 800+ factories that produce 90% of India’s tiles. This cluster generates ₹20,000+ crores investment, provides 600,000+ jobs, and exports to 163 countries. Other manufacturing centers include Tamil Nadu, Haryana, and Rajasthan, but Morbi dominates with world-class infrastructure and economies of scale.